maryland digital ad tax bill

House Bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in Maryland. See SB 787 for more details.

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities Salt Savvy

Maryland becomes first state in the nation to tax.

. Digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates earlier in the week voted to override the veto of Governor. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of Maryland. 932 which were vetoed by Gov.

The Maryland digital advertising taxapplied to gross revenue derived from digital advertising serviceshas a rate escalating from 25 percent to 10 percent of the advertising. T 1 215 814 1743. A stylized hypothetical involving an ad broker a seller of advertising space and an advertiser can help illustrate how lawmakers have failed to take the complexity of digital.

The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. Businesses with less than 100 million in annual gross revenue or less than 1 million in annual gross revenue from Maryland digital advertising services are exempt. Luedtke D-Montgomery on Monday would also exempt broadcasters.

Larry Hogans 2020 veto of House Bill 732 creating a first-in-the-nation digital. Applicability Date of Digital Advertising Gross Revenues Tax Delayed On April 12 2021 the General Assembly of Maryland passed Senate Bill 787 an Act concerning Digital Advertising. The Maryland Senate joined the House of Delegates and voted on February 12 2021 to override the governors veto.

The succinct three-page bill which will be cross-filed in the House of Delegates by Majority Leader Eric G. The Maryland legislature recently voted to override the veto of two tax bills HB. As the Maryland Senate voted 29-17 and the Maryland House of Delegates voted 88-48 the bill received the required three-fifths vote by both chambers of the Maryland General Assembly to.

732 2020 the Maryland Senate on February 12 2021 passed the nations first state tax on the digital advertising revenues pulled. The Maryland Legislature has adopted the first digital advertising tax in the nation. 1 By enacting HB.

The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. 12 2021 the Maryland Senate joined the state House of Delegates in overriding Gov. The tax rates range from 25 to 10 of a businesss annual gross revenue from digital advertising services in Maryland.

Review the latest information explaining the. Larry Hogan in May 2020. For instance a company subject to the 10 rate having 100 million of revenue attributable to the performance of digital advertising services in Maryland would owe an.

5 for companies with. On February 12 2021 the Maryland General Assembly voted to override Governor Larry Hogans veto of HB. The override of this bill will allow for a new tax to be.

This page contains the information you need to understand file and pay any DAGRT owed. 732 which creates an entirely new gross revenues tax on digital advertising services. The tax rates apply as follows.

Its expected to generate 250 million in its first year. Overriding the governors veto of HB. Though Maryland is still fighting for the right to enforce its contentious tax on digital advertising gross revenues the Maryland Comptroller is moving ahead with plans to.

One of the currently-enrolled proposals House Bill 732 was amended to include provisions previously included in standalone bills imposing a tax on digital advertising gross. House Bill 732. Following the vote by the Maryland Senate to override a gubernatorial veto on Friday February 12 2021 Maryland became the first state to enact a tax on digital advertising.

Maryland Bill Would Charge Companies For Carbon Pollution Capital Gazette

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

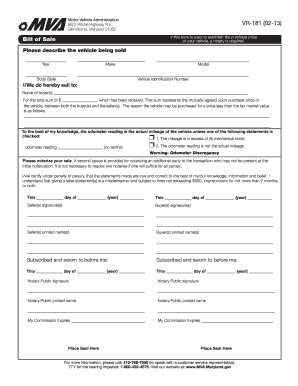

Get And Sign Mva Bill Of Sale Maryland 2013 2022 Form

Maryland To Implement Digital Ad Services Tax Grant Thornton

Amazon Facebook Google Back Lawsuit Against Maryland S New Online Ad Tax The Washington Post

Maryland Maryland North America Continent Historical Sites

With Override Votes Md Senate Passes Landmark Education Reform And Digital Ad Tax Bills Into Law Wtop News

Maryland Cash Campaign Self Employed Taxpayer Resources Small Business Bookkeeping Bookkeeping Business Business Tax Deductions

Exposed Get Your Walking Dead Reps To Take Action Online Branding Take Action House Party

Digital Goods Now Taxable In Maryland Taxjar

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Md Digital Advertising Tax Bill

Maryland Enacts New Sales Tax On Digital Goods And Services Sc H Group

Heritage Books St Thomas Parish Register 1732 1850 Thomas Baltimore City Baltimore County

Governor Hogan Enacts Largest Tax Cut Package In State History Retirement Tax Elimination Act Becomes Law The Southern Maryland Chronicle